4. Internal Control

10. Internal Control

- Status of development of internal control system

- Status of the development of a compliance enhancement system

- Corruption prevention

- Status of development of risk management systems

10.1 Status of development of internal control system

The Systems for Ensuring the Proper Performance of the Company's Business (Basic Policy for Internal Control System) of the Company is as follows. (Last revised June 22, 2023.)

(1) Systems for ensuring that the performance of the duties of Chief Officers and employees of the Company conforms to laws and regulations and to the Articles of Incorporation

(i) The Company establishes compliance regulations and fully disseminates them among all the Chief Officers and employees so that the performance of Chief Officers' and employees' duties conforms to the laws and regulations and to the Articles of Incorporation, adheres to corporate ethics, and fulfills the Company's social responsibilities.

(ii) The Company establishes the Compliance Committee to cultivate a corporate culture in which compliance is importantly recognized.

(iii) The Company puts its directors, chief officers and employees under an obligation to, if they come to know doubtful acts from the viewpoint of compliance in the Company, report such acts to the internal compliance hotline set up outside the Company, which will take proper steps, under guarantee that they will not suffer any disadvantage.

(iv) The entire organization of the Group, including its officers and employees, is resolutely opposed to any antisocial forces or groups that threaten the order and safety of civil society. The Company establishes a structure in which it has no connections whatsoever with antisocial forces.

(2) Systems for keeping and managing information concerning the fulfillment of the duties of the Company's Chief Officers

The Company properly retains and manages information about the fulfillment of the Chief Officers' duties in accordance with the internal regulations regarding the handling thereof.

(3) The Company's regulations for the management of the risk of losses and other systems

The Company establishes risk management regulations as the basis of the risk management system, organizes the Risk Management Committee, and carries out risk management activities in accordance with the said regulations.

(4) Systems for ensuring that the duties of the Company's Chief Officers are efficiently fulfilled

(i) The Company delegates authority related to decisions on business execution to Chief Officers appropriately to expedite decision-making.

(ii) The Management Meeting consisting of all Chief Officers holds a meeting every month in principle and extraordinary meeting as needed to make appropriate decisions about important issues promptly.

(iii) In the conduct of business, the Company makes decisions promptly and efficiently according to the internal regulations including those regarding duties and authorities.

(iv) In order to ensure that the Chief Officers' duties are efficiently fulfilled, the Company establishes appropriate business organizations and segregation of duties.

(5) Systems for ensuring that the Group conducts its business properly

(i) The Company stipulates internal regulations to control the framework used to ensure that the Company is appropriately involved in major decisions taken by its subsidiaries and to request that subsidiaries report to the Company regarding important matters related to business execution. The Company manages and oversees subsidiaries in cooperation with major subsidiaries and ensures that subsidiaries' Directors perform their duties in an efficient manner.

(ii) The Company's internal audit division conducts audits regarding subsidiaries' compliance with laws and regulations and with the Articles of Incorporation, and the effectiveness of the internal control system. The division responsible for the relevant subsidiary properly guides the subsidiary to promptly take appropriate measures to correct or improve these systems, if necessary.

(iii) The Group stipulates the risk management regulations for the Company, and for subsidiaries as appropriate, and identifies and controls group-level risks in cooperation with the Company.

(iv) The Company requests that the Compliance Committee provide reports regarding matters related to subsidiaries' compliance through group-wide efforts in order to ensure Directors' and employees' compliance with laws and regulations and with the Articles of Incorporation. The Company also develops the internal compliance hotline system across the Group, which will take proper steps.

(6) Matters regarding the Directors and employees who are to assist the Audit Committee of the Company, matters regarding the securing of the independence of such Directors and employees from Chief Officers of the Company and the effectiveness of instruction given by the Company's Audit Committee to the employee

(i) An organization for assisting the duties of the Audit Committee shall be established, and the appointment and transfer of the Director and employee shall be subject to the approval of the Audit Committee.

(ii) Persons who belong to the organization for assisting the duties of the Audit Committee shall perform the assistance operations under the direct control and supervision of the Committee. The persons shall be assessed based on opinions of the Committee. No Director shall be appointed to assist in the duties of the Committee.

(7) Systems for reporting to the Audit Committee Members of the Company and other systems for ensuring that the audit by the Audit Committee Members is conducted effectively

(i) Directors (excluding those serving as Audit Committee Members), Chief Officers and employees of the Company, and Directors etc., Auditors, and employees of the Company's subsidiaries, or those who receive reports from these persons shall report to the Company’s Audit Committee findings of internal audits, etc. and the status of whistle-blowing to the hotline directly or through meetings, etc. with the organization that assists in the duties of the Audit Committee in addition to important matters determined by the Board of Directors and the Management Meeting.

(ii) The Audit Committee Members may request and inspect any documents or reports from Directors, Chief Officers or employees of the Company and its subsidiaries for the purpose of conducting an audit.

(iii) The Group does not treat those who provide the above reports disadvantageously based on the fact that they have made such reports to Audit Committee Members.

(iv) The Company allocates a budget that covers expenses incurred for audits performed by Audit Committee Members so as to ensure the effectiveness of the audit.

10.2 Status of the development of a compliance enhancement system

The Group believes compliance is an important management issue. The Company and the Group companies have established compliance regulations. Each company has a compliance manager to ensure compliance with laws and regulations and prevent bribery, misconduct, fraud and harassment and they strive to exclude anti-social forces from their activities.

To increase awareness of compliance, the Group continues every year to send company newsletters with compliance topics (available to all employees) and to provide e-learning programs (to all full-time employees and contract employees). To reinforce measures to uncover wrongdoing, the Group conducts surveys of all of the Group's employees (full-time employees, contract employees, part-time employees, and dispatched temporary employees) to identify wrongdoing at an early stage and checks internal controls within each division using a fraud prevention checklist (distributed to division heads).

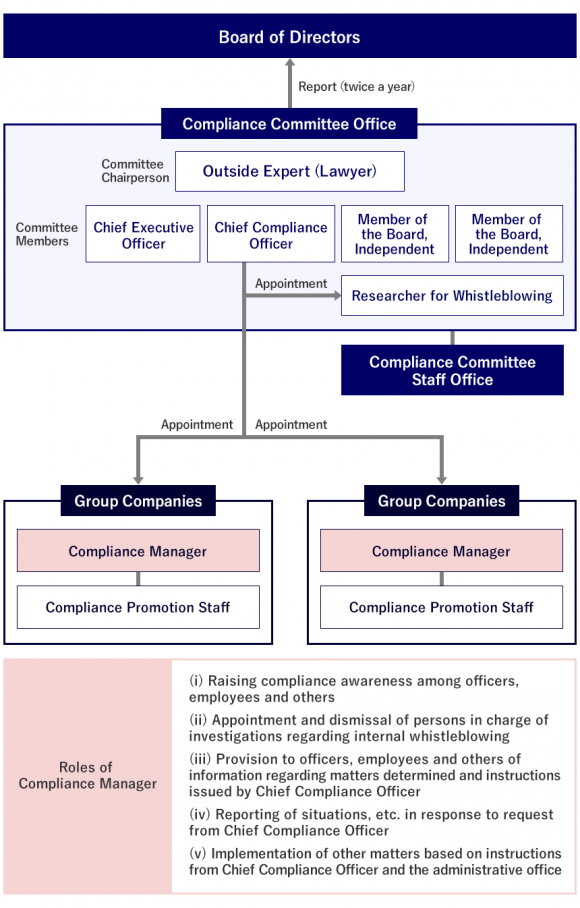

(1) Diagram of compliance promotion structure

The Compliance Committee, the core of the promotion system, is chaired by an outside expert (lawyer). It is building a corporate culture that emphasizes compliance under stricter external supervision as a majority of Committee members are outsiders, including Outside Directors. The status of activities of the Compliance Committee is reported to the Board of Directors once every six months, and with respect to the regular audit system regarding ethical standards, the Audit Committee Members attend Compliance Committee meetings and conduct regular audits.

(2) Establishment of a whistleblowing office

The KADOKAWA Group has established a whistleblowing office within a third-party organization as a Group-wide contact point and manages an internal whistleblowing system that considers whistleblower’s protection in compliance with the Whistle-Blower Protection Act. Whistleblowers can contact the office anonymously or using their real names if they choose to. Either way, the information is strictly protected. The Group handles information appropriately to ensure that no whistleblower or individual is unfairly treated in any way because of their whistleblowing or consulting, including their dismissal or the degradation of their work environment. After a report is received, the Group will establish an investigation team according to the content of the report. The team will investigate and take corrective action appropriately based on its findings. The Compliance Committee will report to the Board of Directors twice a year. In addition to reactive measures in response to whistleblowing reports, the Group engages in activities to gain an understanding of potential compliance risks such as the status of compliance within the Group and employee awareness and the corporate culture through the implementation of a compliance questionnaire survey targeting all employees of the Group.

- Whistleblowing office:

-

1. Web form

https://koueki-tsuhou.com/sLMfZe8Pka9s/en/

- The following people are eligible to use the whistleblowing office:

-

- Officers and employees of the Company and group companies (officers, employees, contract employees, fixed-time employees, part-timers, dispatched temporary employees)

- Retiree

- Business partners

- Reportable facts:

-

Act that is or is suspected to be in violation of laws, regulations, or internal rules

(Examples)- Fraudulent act that causes damage to corporate assets

- Inappropriate relationship with business partner

- Unjust act against subcontractor

- Disclosure/leakage of personal/confidential information to third party

- Fraudulent accounting treatment

- Harassment prohibited by the employment rules

10.3 Corruption prevention

To maintain healthy relationships with business partners, the KADOKAWA Group strives to ensure thorough compliance by working to prevent bribery, sever ties with antisocial forces and observe fair trade as set in its Compliance Policy.

- Relevant items in the Compliance Policy

-

4. We will maintain sound relationships with our business partners.

- We will conduct fair, transparent and free transactions with business partners involved in the creation of the Group's IP, maintain sound and normal relationships with them, and make no unreasonable demands, and we will not engage in bribery, corruption or corrupt practices.

- We will engage in sound competition and comply with antitrust laws and other laws and regulations governing business transactions.

- We will not do business with organized crime groups and other anti-social forces.

(KADOKAWA Group Compliance Policy https://group.kadokawa.co.jp/global/compliance_policy/ )

- Anti-Bribery Policy

-

The KADOKAWA Group has established an anti-bribery policy as a fundamental policy to enhance its legal compliance framework and uphold high ethical standards based on the relevant items in accordance with the KADOKAWA Group Compliance Policy. The objective of the Policy is compliance with the laws and regulations pertaining to the giving or receiving of bribes that may arise in connection with the Group’s business activities.

(KADOKAWA Group Anti-Bribery Policy https://group.kadokawa.co.jp/global/antibribery_policy/)

Our approach to preventing corruption

The KADOKAWA Group is implementing the following specific initiatives to prevent corruption under its “Compliance Promotion System.”

- (1) Education and training

We regularly provide education and training on the implementation of laws, regulations and procedures for the Group's officers and employees and strive to raise their awareness and improve their knowledge, so that each of them can thoroughly implement compliance as their own responsibility. To motivate them to take part, we provide education using both a guidebook that covers what the Company must comply with and animated video content, and conduct tests semiannually. We also visit each workplace and hold seminars on legal compliance.

- (2) Monitoring

The Compliance Committee deliberates on the status of the Group's initiatives and reports the results to the Board of Directors. In addition, to eliminate antisocial forces, we have introduced “antisocial checks” at the “entrance” stage at the time when we start new business transactions, for example, as well as “monitoring” of existing business partners.

- (3) Internal whistleblowing

We operate a whistleblowing system to detect corrupt or suspicious behaviors by officers and employees of the Group at an early stage, prevent corruption and promptly correct it.

10.4 Status of development of risk management systems

The Company has developed an enterprise risk management system through the establishment of a Risk Management Committee (convened twice a year) that is chaired by CEO and made up of the Chief Officers of business and other divisions, among others. The Risk Management Committee promotes risk control by gathering and analyzing information about risks surrounding the Group, including risks that might and have occurred, and selects the risks to be addressed as a priority each year and takes actions to address them.

Governance

-

1. Management policy and corporate governance

-

2. Board of Directors, Nominating Committee, Remuneration Committee, Audit Committee, Independent Auditors

-

3. Remuneration for Directors and Chief Officers

-

5. Information on shareholdings, takeover defense measures

-

6. IR policy, enhancement of disclosure and insider information control