1. Initiatives to address climate change

Initiatives to address climate change

The KADOKAWA Group sees climate change as an urgent social issue and is working to reduce greenhouse gases and conserve energy.

By introducing a work style that allows employees to autonomously choose between “mainly office” and “mainly telecommuting,” the Group eliminated rules requiring office commutes, leading to a reduction in greenhouse gas emissions from employee commutes and movement.

In the editing process for publishing, tablet devices were introduced and it has become possible to send data for printing and complete proofreading with PDFs by promoting improvements in rules with partner companies (printing companies). In doing so, the Group achieved reductions of transporting draft paper to the printing site.

The KADOKAWA Group will continue to promote disclosure of climate change-related information and work on sustainable business activities that lower its burden on the environment.

Response to the TCFD recommendations

The impact of climate change has been growing more serious every year, greatly affecting the economy, society and the environment. International society is accelerating its moves toward the establishment of a low-carbon/carbon-free society, and the roles that companies will play have been growing increasingly important.

From the Environmental, Social and Governance (ESG) perspectives, the KADOKAWA Group focuses on solving social issues which change with the times, as well as business growth and meeting the expectations of its customers, shareholders, business partners, local communities and other stakeholders, aiming to create a better society and a continual improvement of corporate value.

Understanding that addressing climate change is an urgent task that society must accomplish, the Group works to reduce greenhouse gas emissions and conserve energy.

In support of the Task Force on Climate-related Financial Disclosures (hereinafter the "TCFD") and the final report they published (hereinafter the "TCFD recommendations"), the KADOKAWA Group has disclosed information in accordance with the TCFD recommendations. The Group will continue striving to disclose more climate change-related information following the TCFD recommendations and move ahead with its sustainable business activities with reduced environmental impact.

(1) Governance

The KADOKAWA Group understands that addressing climate change risks, which has become a global issue, is one of its most important tasks.

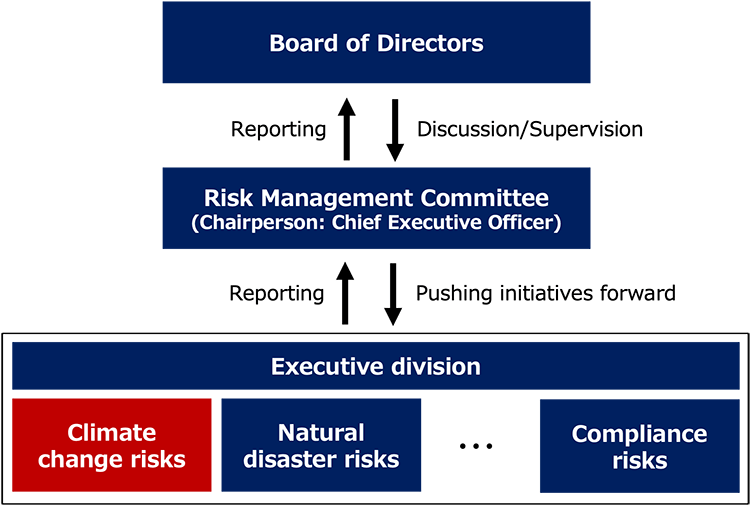

Specifically, the Risk Management Committee chaired by Chief Executive Officer analyzes and addresses the risks faced by the Group as a whole, including climate change risks, under the supervision of the Board of Directors.

Climate change risks are discussed and considered at the meetings of the Risk Management Committee (held two times a year) as a part of company-wide risk management. The Group pushed initiatives forward including the consideration of measures to address identified risks and the reduction of CO2 emissions.

The Board of Directors receives reports on important matters discussed by the Risk Management Committee. It also discusses and supervises action plans for addressing climate change problems and other initiatives.

(2) Strategies

The KADOKAWA Group performed a scenario analysis based on risks and opportunities to be created by climate change, which are illustrated by examples in the TCFD recommendations.

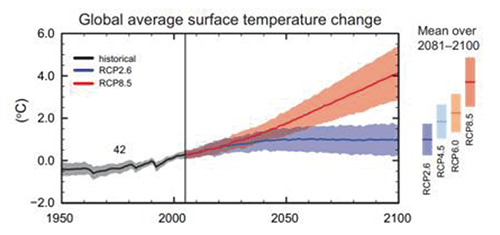

The Group selected two scenarios for the analysis because it is necessary to select and set scenarios for multiple temperature ranges, including a 2 °C or lower scenario. One is the 1.5 °C scenario, in which the impact of the transition is realized. The other is the 4 °C scenario, in which the physical impact of climate change is realized.

The scope of the analysis included KADOKAWA CORPORATION which is the mainstay business.

<Global average surface temperature change (difference from the average temperature for the period 1986 - 2005)>

*Source: IPCC AR5 WG I SPM Fig. SPM.7(a)

【1.5 °C scenario1】

In this scenario, rigorous measures are taken to address climate change and the temperature increase is limited to around 1.5 °C above pre-industrial levels as of 2100.

Measures to address climate change are strengthened, and transition risks increase regarding political regulation, markets, technology, reputation, and other matters.

1 As the parameters for estimating impact, the RCP2.6 scenario was used referencing information from the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IAE).

【4 °C scenario2】

In this scenario, rigorous measures are not taken to address climate change, and the temperature has increased to around 4 °C above pre-industrial levels as of 2100.

This leads to greater physical risks, including risks related to serious natural disasters, sea level rise, and more frequent abnormal weather.

2 As the parameters for estimating impact, the RCP8.5 scenario was used referencing information from the Intergovernmental Panel on Climate Change (IPCC) and the International Energy Agency (IAE).

<1.5 ℃ climate change scenario>

| Climate change risk/opportunity | Global change | Conceivable scenario | Risks | Opportunities | Time of occurrence | |

|---|---|---|---|---|---|---|

| Transition risks and opportunities | Policies and legal restrictions | Tougher environmental regulations related to GHG emissions | Increase in energy cost resulting from rising prices of renewable energy | ○ | - | Medium to long term |

| Introduction of carbon taxes and emissions trading | Increase in cost resulting from introduction of carbon taxes and emissions trading | △ | - | Medium to long term | ||

| Markets and technologies | Rapid progress in carbon reduction (energy conservation), decarbonization, and transition to renewable energy | Increase in capital expenditures for the reduction of power consumption | ○ | - | Medium to long term | |

| Increase in procurement costs | Production and procurement costs increase because the prices of paper resources and other raw materials increase, reflecting carbon taxes and costs for the response to environmental regulations. | ○ | - | Medium to long term | ||

| More environmental measures required of publishers | Increase in demand related to the Company's proprietary digital production and distribution processes for paper-based books | - | ○ | Medium to long term | ||

| Growing demand for e-books and other digital content | Growing demand for e-books in the publication business | - | ○ | Medium to long term | ||

| Reputation | Changes in stakeholders' evaluations related to climate change | A decline in corporate value and credibility for stakeholders, a result of the delayed environmental initiatives including measures to address climate change | ○ | - | Medium to long term | |

◎:Great impact ○:Some impact △:Minor impact

<4 ℃ climate change scenario>

| Climate change risk/opportunity | Global change | Conceivable scenario | Risks | Opportunities | Time of occurrence | |

|---|---|---|---|---|---|---|

| Physical risks and opportunities | Chronic | Changes in rainfall and weather patterns (rise of the average temperature) | Generation of capital expenditure costs related to disaster control at key business locations | ○ | - | Long-term |

| Increase in power consumption for air conditioning resulting from a rise in the average temperature | ○ | - | Long-term | |||

| Acute | Greater seriousness and higher frequency of abnormal weather (typhoons, bush fires, flooding, and rainstorms) | Higher frequency of forest fires affects the stability of the supply of papermaking materials and causes an increase in paper procurement costs. | ◎ | - | Long-term | |

| Shutdown and supply chain disruption affecting production and procurement | ◎ | - | Long-term | |||

| Interruption of content streaming due to power outages caused by natural disasters | ◎ | - | Long-term | |||

◎:Great impact ○:Some impact △:Minor impact

Consideration of transition risks and opportunities was based on a decarbonization scenario in which a variety of regulations, etc. are introduced, towards the achievement of the 1.5 ℃ target.

It is assumed in the 1.5 °C or lower scenario that carbon taxes associated with tightening of environmental regulations will be introduced by governments, there will be an increase in costs, including price hikes resulting from growing demand for renewable energy, and an increase in capital expenditures for the reduction of power consumption.

It is also assumed that while demand for paper-based books will decline, partly reflecting growing awareness of sustainability including an awareness of environmental problems, demand for e-books, etc. will increase due to the diversification of consumers' tastes, including growing demand for digital content. With the fusion of real and digital, the Company provides the IPs’ worldviews through new user experience (UX) and maximizes the IPs’ values, in its efforts to achieve sustainable growth. In the e-book market, the Company is driving global expansion by strengthening investment in the field of web comics, a global growth market. It invests in operations related to vertical scrolling comics, that is, production, translation into multiple languages, sales, and platform development.

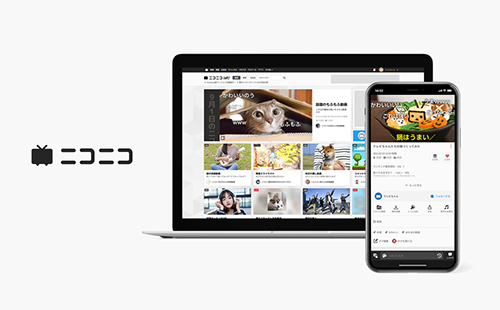

In addition, the KADOKAWA Group is pushing forward with its own digital transformation (DX), aiming to provide high-quality content and services and improve employees' productivity. In the digital innovation of publication, the Group is taking the lead in the full digitalization of publication to help reduce the excessive consumption of paper. For example, it has introduced direct order tablets (DOT) to bookstores and built the Book Production and Distribution Facilities with state-of-the-art digital printing equipment at TOKOROZAWA SAKURA TOWN. It is likely that, reflecting growing environmental awareness, these unique initiatives of the Company will accelerate and become a part of the publication industry as new production and distribution standards, capturing demand from other companies. The Company will continue to promote activities aimed at ensuring the sustainability of the environment regarding production, distribution, and sales as well.

Among the physical risks and opportunities, the suspension of business activities and supply chain disruptions, which will result from natural disasters caused by abnormal weather, will be major risks. The occurrence of a natural disaster is difficult to predict. When a disaster occurs, it will cause serious damage. At present, the ongoing global warming is causing extreme weather phenomena, such as disastrous heavy rains. In the scenario of increasing global warming, this trend is expected to increase. Further, the increasing global warming will result in more frequent forest fires, which are expected to affect the stability of the supply of papermaking materials and increase paper procurement costs.

The Company is pushing forward with the full digitalization of publication and has promoted a workstyle that permits all employees to work in a self-directed manner, anytime, anywhere, aiming to build an environment where employees can ensure the same quality of work from anywhere. In addition, the Company has built a framework for its business continuity plan (BCP) so that it can respond to major disasters including disasters caused by climate change. The Company will strengthen its disaster response and supply chain management associated with climate change.

A possible financial impact of climate change risks will be the introduction of carbon taxes, a result of governments tightening their environmental regulations. Therefore, the Company calculated the effect of the introduction of carbon taxes in 2030 and 2050 in the 4 ℃ scenario and 1.5 ℃ or lower scenario by assuming that GHG emissions are equivalent to the FY2020 level. In addition, the Company estimated values using one scenario from the International Energy Agency (IEA), one from the International Renewable Energy Agency (IRENA), and the current carbon price (carbon cap-and-trade system, carbon tax, and energy taxation). In either of the scenarios, the cost increase resulting from introduction of carbon tax is expected to be minor in light of the current business performance of the Company. In addition, it is expected that the impact will be alleviated at the time the carbon taxes are introduced because the Company plans to reduce its GHG emissions by introducing renewable energy and through other initiatives.

| 1.5 ℃ or lower — 4 ℃ scenarios | ||

|---|---|---|

| Carbon tax price | Cost increase resulting from the introduction of carbon taxes | |

| 2030 | Approx. 2,500 - 11,000 yen/t-CO2 | Approx. 9.5 - 42 million yen |

| 2050 | Approx. 4,800 - 18,000 yen/t-CO2 | Approx. 18 - 69 million yen |

(Preconditions)

・Reference scenario: STEPS Scenario (a scenario in which measures already introduced or announced officially are implemented), IEA (2020), World Energy Outlook 2020

(Estimation data)

・The Company's greenhouse gas emissions (FY2020): Approx. 3,783 t-CO2

(3) Risk management

The Group has established Risk Management Rules. Under the rules, the Group has created the Risk Management Committee. The chairperson of the committee is Chief Executive Officer, and the members are the Chief Officers of the divisions. The executive office is the division responsible for internal control. The committee meets twice a year and reports its activities to the Board of Directors.

To manage risks, each division selects major risks, considering internal factors (management resources, business characteristics, etc.) and external factors (infectious diseases, climate change risk, etc.), and develops measures to address these risks. The division in charge of internal control monitors each division's activities and continually improves activities.

Above all, the Company positions climate change risks as one of the important groups of company-wide risks. To understand and evaluate the impact of climate change, the Company performs scenario analyses based on the TCFD framework, considers the impact on the Company, and reports the results to the Risk Management Committee. Matters related to decisions regarding risk management and material risks, including climate change risks, are reported to the Board of Directors along with recommendations.

(4) Metrics and targets

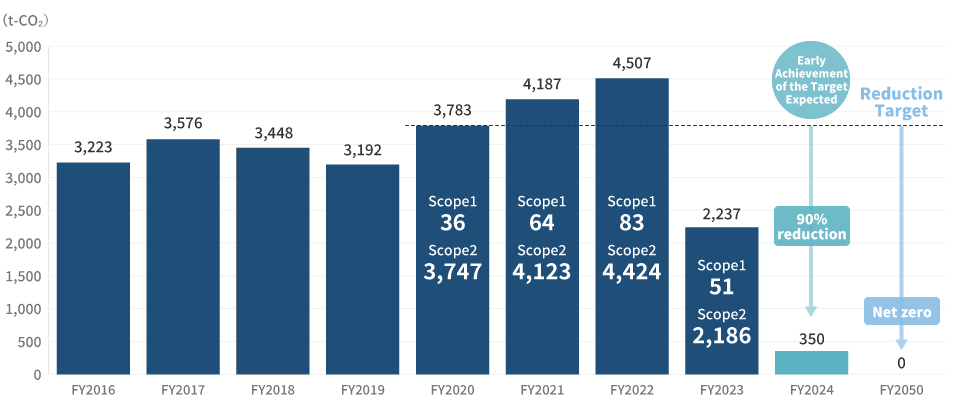

In FY2023, Scope 1 GHG emissions (direct emissions from business operations) were 51t-CO2 and Scope 2 GHG emissions (indirect emissions from power consumption) were 2,186t-CO2. In total, the emissions amounted to 2,237t-CO2. *These figures reflect emissions recalculated with the use of the emission factor after adjustment updated by the Ministry of Economy, Trade and Industry in July 2024. The figures were updated on December 23, 2024.

Regarding Scope 1 and 2 emissions, KADOKAWA has set the targets of reducing them by 50% from the FY2020 level by FY2030 and achieving net zero emissions by FY2050, in consideration of the required level of CO2 emissions reductions laid out in Science Based Targets (SBT) towards the establishment of a sustainable society.

As the decarbonization initiative, on January 1, 2023, four of our buildings located in Chiyoda Ward, Tokyo including KADOKAWA Headquarter Building, KADOKAWA 2nd Headquarter Building, KADOKAWA Annex Building and KADOKAWA Fujimi Building virtually started obtaining electric power solely from renewable energy. In addition, TOKOROZAWA SAKURA TOWN (Tokorozawa City, Saitama), one of our business sites, has also switched to electricity from renewable energy since December 1, 2023. The electric power before these changes was responsible for 76.9% of our annual CO2 emissions in FY2022, which amounted to approximately 3,468 t-CO2. The changes are intended to replace it with virtually CO2-free electricity. We now expect to cut CO2 emissions by around 90% (approximately 3,433 t-CO2) from FY2020 level (approximately 3,783 t-CO2) and to reach our target, which is a 50% reduction from the FY2020 level by FY2030, ahead of schedule.

From March 31, 2024, the KADOKAWA Group switched all of the power used for KADOKAWA DAIEI STUDIO CO., LTD.’s Chofu Studio to renewable energy. As a result, the CO2 emissions generated by the power used by this studio are now net zero. We are carrying out initiatives at each of our business bases to ensure that the entire Group achieves these targets. To reduce greenhouse gas (GHG) emissions, in addition to endeavoring to conserve energy within the Company, we will take measures such as utilizing the Japanese government’s J-Credit Scheme to contribute to the realization of a zero-carbon society.

Scope

Head office, other offices, and TOKOROZAWA SAKURA TOWN of KADOKAWA CORPORATION

Energy Use Over The Last Five Years

The Group continues to work on conserving energy in the office, and aims for a more efficient use of energy through combining and reorganizing its offices.

After FY2020, electricity consumption increased due to the operation of Tokorozawa Sakura Town, which includes the Tokorozawa Campus. However, we will continue our efforts to reduce energy consumption by implementing power-saving measures, including the use of power-saving LED lighting, and by considering the optimal office layout from the perspective of energy use. We will continue our efforts to reduce energy consumption.

| FY2019 | FY2020 | FY2021 | FY2022 | FY2023 | |

|---|---|---|---|---|---|

| Energy Use GJ |

45,333 | 78,086 | 99,205 | 104,664 | 99,377 |

| (Breakdown) | |||||

| Fuel (A-type heavy fuel) kl |

6 | 6 | 8 | 6 | 6 |

| Electricity: thousand kWh |

4,603 |

7,883 |

9,954 |

10,554 |

11,350 |

*Energy used by the KADOKAWA CORPORATION